Mandatory reporting on cross-border tax planning Background An EU-directive on mandatory disclosure rules (Council Directive on administrative cooperation in the field of taxation, so called “DAC6”) aimed at increasing transparency to detect potentially aggressive cross-border tax planning became effective in June 2018. DAC6 applies to cross-border tax arrangements, which meet one or more specified characteristics (hallmarks), and which concern either […]

Blog

VAT liability for cross-border transportation services: Important changes for forwarding agents

VAT liability for cross-border transportation services: Important changes for forwarding agents Cross-border forwarding services (transportation of goods) in connection with third (non-EU) countries are under certain circumstances VAT-free (§4 Nr. 3a German VAT Code). Based on the decision of the European Court of Justice dated 29 June 2017, the German Federal Ministry of Finance has issued a letter on 6 […]

Deadline to register POS systems at German tax office has been extended until September 30, 2020

Deadline to register POS systems at German tax office has been extended until September 30, 2020 Companies with electronic cash registers or cash register systems (“POS systems”) are obliged by the so-called “Cash Register Act” to equip them with a certified technical security device (TSE) from January 1, 2020. From January 1, 2020, companies must report their POS systems and […]

Short-time allowance (Kurzarbeitergeld or KUG) during corona: FAQs

Short-time allowance (Kurzarbeitergeld or KUG) during Corona: FAQs A difficult economic development or an unpredictable event such as corona can make short-time work necessary in a company. The resulting loss of earnings can be partially compensated with short-time work allowance. At the end of April 2020, German Federal Employment Agency reported KUG applications submitted by companies for more than 10 […]

Home office during corona: Tax aspects

Home office during Corona: Tax aspects Employees are currently being sent to the home office due to precautions in the context of the corona situation. It is questionable whether and to what extent expenditure during home office can be claimed against tax. Principle If the home office forms the center of all operational and professional activity, the full amount of […]

Coronavirus: Employee allowances are tax-free up to EUR 1,500 during the corona pandemic

Coronavirus: Employee allowances are tax-free up to EUR 1,500 during the corona pandemic In times of the corona pandemic, in Germany, special payments for employees up to an amount of EUR 1,500 will be made tax and social security free in 2020. Employers can now pay subsidies up to an amount of EUR 1,500 tax-free to their employees or grant […]

Raising growth capital

Issue Our client, an emerging online mail order company, was faced with the challenge of supporting the rapid growth of its business with sufficient operating resources. To meet this urgent capital requirement, we leveraged our expertise and extensive connections to successfully access external financing. This enabled the company to secure its operating resources and fully exploit its growth potential. Solution […]

Support for a multinational group

Issue Due to staff shortages, our client was unable to ensure proper financial accounting. Solution The s&w team supported our multinational corporate client over a longer period of time (> 1 year) to stabilize and improve their financial and accounting function. Our services: Preparation and implementation of planning for accounting Support in the timely preparation of monthly and annual financial […]

Help with criminal tax case

Issue Over an extended period of time, our client failed to report income in excess of EUR 2.5 million to the German tax office, which eventually led to the initiation of a tax investigation. After a thorough house search, criminal proceedings were initiated, including a potential back tax payment of over EUR 1 million and the prospect of a prison […]

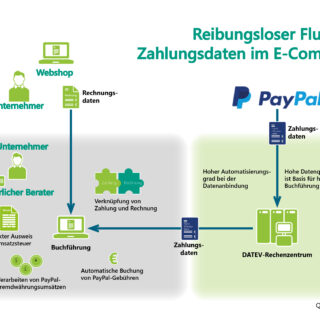

Digitalization of accounting

Issue The supplier, specializing in providing classic car spare parts through its online shipping platform, encountered a significant challenge when it came to reconciling outgoing invoices generated by their Enterprise Resource Planning (ERP) software, specifically JTL. This hurdle gave rise to a concerning accumulation of open items within their financial records, primarily in the form of unpaid invoices as well […]